Crooked lawyers give Scotland a bad name. While the attention of most remains focussed on the crisis in the banking system, the problems which have caused the collapse of our great financial institutions are nothing new to Scotland's legal sector. Year in year out, clients have been losing millions of pounds of their money to , ambitions, greedy, and downright crooked lawyers over the past couple of decades, and the regulator responsible, the Law Society of Scotland, has done little or nothing about it.

Crooked lawyers give Scotland a bad name. While the attention of most remains focussed on the crisis in the banking system, the problems which have caused the collapse of our great financial institutions are nothing new to Scotland's legal sector. Year in year out, clients have been losing millions of pounds of their money to , ambitions, greedy, and downright crooked lawyers over the past couple of decades, and the regulator responsible, the Law Society of Scotland, has done little or nothing about it.

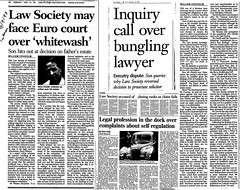

A crooked lawyer’s tangled web of deceit. During 1991, one of the most famous cases of fraud by the Scots legal profession occurred with revelations that John McCabe, a solicitor working at the now defunct Edinburgh firm of Scott Moncrieff & Dove Lockhart, operated a multi million pound fraud scam against clients & banks, which ultimately was discovered after he became careless and so entrenched in deceit & debt, there was simply no place left to run (although he did try running to Uruguay). While clients stood ruined, and banks took huge losses, the Law Society of Scotland could only watch on as the press of the day mauled both the legal profession and the poor standards of regulation which allowed McCabe to get away with what he did, and ultimately, McCabe was jailed for 10 years for his crimes.

A crooked lawyer’s tangled web of deceit. During 1991, one of the most famous cases of fraud by the Scots legal profession occurred with revelations that John McCabe, a solicitor working at the now defunct Edinburgh firm of Scott Moncrieff & Dove Lockhart, operated a multi million pound fraud scam against clients & banks, which ultimately was discovered after he became careless and so entrenched in deceit & debt, there was simply no place left to run (although he did try running to Uruguay). While clients stood ruined, and banks took huge losses, the Law Society of Scotland could only watch on as the press of the day mauled both the legal profession and the poor standards of regulation which allowed McCabe to get away with what he did, and ultimately, McCabe was jailed for 10 years for his crimes.

Just imagine for a minute, if every one of the 10,000 lawyers in Scotland stole £4million from their clients. What would be done about it ? .. well nothing much, as long as the Law Society has anything to do with regulating lawyers …

Law Society Chief Kenneth Pritchard failed on reforms. Amid the recriminations of the McCabe case, and the costs of compensating his victims, the Law Society's Kenneth Pritchard (now a Sheriff), promised reforms to ensure no repetition, and that standards would rise in Scotland's legal profession to ensure public confidence remained in solicitors.

Law Society Chief Kenneth Pritchard failed on reforms. Amid the recriminations of the McCabe case, and the costs of compensating his victims, the Law Society's Kenneth Pritchard (now a Sheriff), promised reforms to ensure no repetition, and that standards would rise in Scotland's legal profession to ensure public confidence remained in solicitors.

Kenneth Pritchard : “The aim of the new rules … is not to help the legal profession shrug off an obligation to meet losses, but to reduce the amount the Guarantee Fund might have to repay. "It should become much more difficult for solicitors to defraud clients. “There is not a reluctance among solicitors to pay this money. there is an acceptance that we must do so to maintain the good name and standing of the profession.". What good name ?

Law Society Chief Pritchard performs a u-turn & orders legal firm to drop 'crooked lawyers' case. However, three years on in 1994, the same Law Society Chief, Kenneth Pritchard who had promised reforms to prevent crooked lawyers hurting their clients, was revealed to have personally intervened in a case of litigation against a firm of crooked lawyers, ordering the clients solicitors to withdraw from acting, letting the crooked lawyers off the hook in a policy of protection for crooked lawyers.

Law Society Chief Pritchard performs a u-turn & orders legal firm to drop 'crooked lawyers' case. However, three years on in 1994, the same Law Society Chief, Kenneth Pritchard who had promised reforms to prevent crooked lawyers hurting their clients, was revealed to have personally intervened in a case of litigation against a firm of crooked lawyers, ordering the clients solicitors to withdraw from acting, letting the crooked lawyers off the hook in a policy of protection for crooked lawyers.

Court documents revealed Law Chief's duplicity. Kenneth Pritchard wrote to legal firm Skene Edwards advising them to withdraw from acting in the case, and that letter was subsequently discussed in the Scottish Parliament debate chamber by Cabinet Secretary for Business John Swinney.

Court documents revealed Law Chief's duplicity. Kenneth Pritchard wrote to legal firm Skene Edwards advising them to withdraw from acting in the case, and that letter was subsequently discussed in the Scottish Parliament debate chamber by Cabinet Secretary for Business John Swinney.

You can read more about how the Law Society of Scotland and Kenneth Pritchard did nothing to stem the rising tide of crooked lawyers, and actually closed ranks with crooked lawyers to protect them from punishment while denying clients access to justice, here : Law Society intervention in claims 'commonplace' as ex Chief admits Master Policy protects solicitors against clients

After the exploits of McCabe, the Law Society of Scotland professed to have 'cleaned up Scotland's legal profession, but much worse was to come as the following demonstrates.

Borders lawyer Andrew Penman became Scotland's most famous crooked lawyer. From 1994 to the present day, my own battle with the Law Society of Scotland ended up in the press, showing yet again the Law Society of Scotland would simply close ranks with crooked lawyers to protect them from client complaints & financial claims for dishonesty & fraud. Indeed, the Law Society went out of its way in a determined effort to prevent me from obtaining legal representation and access to the courts to pursue Penman and his legal firm Stormonth Darling solicitors, for the untold damage it did to my family. Nothing then had changed - there were still plenty of crooked lawyers in business, and the Law Society of Scotland still covered up for crooked lawyers no matter what.

Borders lawyer Andrew Penman became Scotland's most famous crooked lawyer. From 1994 to the present day, my own battle with the Law Society of Scotland ended up in the press, showing yet again the Law Society of Scotland would simply close ranks with crooked lawyers to protect them from client complaints & financial claims for dishonesty & fraud. Indeed, the Law Society went out of its way in a determined effort to prevent me from obtaining legal representation and access to the courts to pursue Penman and his legal firm Stormonth Darling solicitors, for the untold damage it did to my family. Nothing then had changed - there were still plenty of crooked lawyers in business, and the Law Society of Scotland still covered up for crooked lawyers no matter what.

Proposals since 1999 to bring independent regulation to lawyers were blocked by Law Society. The legacy of Andrew Penman, and the cover up by the Law Society of his actions was felt by all solicitors just as in the McCabe case, and assisted with the drive to bring about independent regulation of lawyers and end the closed shop operated by the Law Society of Scotland that allowed thousands of complaints to be binned while investigations were whitewashed.

Proposals since 1999 to bring independent regulation to lawyers were blocked by Law Society. The legacy of Andrew Penman, and the cover up by the Law Society of his actions was felt by all solicitors just as in the McCabe case, and assisted with the drive to bring about independent regulation of lawyers and end the closed shop operated by the Law Society of Scotland that allowed thousands of complaints to be binned while investigations were whitewashed.

2006, and still plenty crooked lawyers in Scotland. Things are now so bad in Scotland that many solicitors & legal firms have 'toxic levels of client complaints & claims' for poor legal service, rendering the use of Scots solicitors a dangerous game of Russian roulette for consumers, where selecting the worst of a bad bunch can see you end up financially ruined and your lives destroyed by a greedy lawyer out to take as much as possible, safe in the knowledge his regulator, the Law Society of Scotland, will do nothing to help members of the public.

2006, and still plenty crooked lawyers in Scotland. Things are now so bad in Scotland that many solicitors & legal firms have 'toxic levels of client complaints & claims' for poor legal service, rendering the use of Scots solicitors a dangerous game of Russian roulette for consumers, where selecting the worst of a bad bunch can see you end up financially ruined and your lives destroyed by a greedy lawyer out to take as much as possible, safe in the knowledge his regulator, the Law Society of Scotland, will do nothing to help members of the public.

Lawyers staged mafia hit on one of their own. Indeed the corruption of Scotland's legal profession became so entrenched, the Law Society's own Chief Accountant, Leslie Cumming, was subject to a mafia hit, staged by crooked lawyers in an attempt it has since been claimed to put off investigations into crooked lawyers .. and while the then Law Society Chief Douglas Mill was busy blaming clients for the attack on Cumming, it became clear to all the motives for the attack came from within the ranks of Scotland's solicitors, who had become so evil they would consider and use murder hits to escape justice for their vast network of corruption against clients.

Lawyers staged mafia hit on one of their own. Indeed the corruption of Scotland's legal profession became so entrenched, the Law Society's own Chief Accountant, Leslie Cumming, was subject to a mafia hit, staged by crooked lawyers in an attempt it has since been claimed to put off investigations into crooked lawyers .. and while the then Law Society Chief Douglas Mill was busy blaming clients for the attack on Cumming, it became clear to all the motives for the attack came from within the ranks of Scotland's solicitors, who had become so evil they would consider and use murder hits to escape justice for their vast network of corruption against clients.

2007, and even more crooked lawyers. The media coverage of countless scandals within the Scots legal establishment, and the Law Society’s seeming ability to whitewash any crooked lawyer, no matter the crimes they had committed, ultimately brought about the creation of legislation passed in 2007 to 'improve' regulation of the legal profession, however the 'independent' Scottish legal Complaints Commission which was created as a result of the LPLA (Scotland) Act 2007 has since been co-opted by the Law Society, and is mired in many scandals itself, as the legal profession fights back to retain its crooked regulatory powers over crooked lawyers.

2007, and even more crooked lawyers. The media coverage of countless scandals within the Scots legal establishment, and the Law Society’s seeming ability to whitewash any crooked lawyer, no matter the crimes they had committed, ultimately brought about the creation of legislation passed in 2007 to 'improve' regulation of the legal profession, however the 'independent' Scottish legal Complaints Commission which was created as a result of the LPLA (Scotland) Act 2007 has since been co-opted by the Law Society, and is mired in many scandals itself, as the legal profession fights back to retain its crooked regulatory powers over crooked lawyers.

Let us finally take a look at some of the people who have perpetuated this disgraceful state of affairs the Scots legal services market finds itself in :

Douglas Mill, ex-Chief Exec. of the Law Society. Douglas Mill, recently famed on television for supporting Sir Fred Goodwin who brought RBS to its knees, made no bones about it, he had no time for clients who complained against crooked lawyers, and saw it as his mission to interfere in complaints & financial claims against crooked lawyers. Mill horrendously hounded clients who dared make a complaint against a solicitor, and personally saw to it that attempts at legal action against solicitors failed at every turn, even demanding legal aid be refused to anyone seeking to take a lawyer to court.

Douglas Mill, ex-Chief Exec. of the Law Society. Douglas Mill, recently famed on television for supporting Sir Fred Goodwin who brought RBS to its knees, made no bones about it, he had no time for clients who complained against crooked lawyers, and saw it as his mission to interfere in complaints & financial claims against crooked lawyers. Mill horrendously hounded clients who dared make a complaint against a solicitor, and personally saw to it that attempts at legal action against solicitors failed at every turn, even demanding legal aid be refused to anyone seeking to take a lawyer to court.

Philip Yelland, Head of Client Relations. During all this time, and all these scandals, one man has been the key to ‘Client Relations’ at the Law Society of Scotland, Mr Philip Yelland, who has presided over scandal after scandal, where curiously many of the crooked lawyers got off the hook, or investigations were simply whitewashed, while the Law Society saw to it members of the public were denied access to justice and a solicitor to try and pursue the thousands of McCabes and Penmans for the damage they did to many clients.

Philip Yelland, Head of Client Relations. During all this time, and all these scandals, one man has been the key to ‘Client Relations’ at the Law Society of Scotland, Mr Philip Yelland, who has presided over scandal after scandal, where curiously many of the crooked lawyers got off the hook, or investigations were simply whitewashed, while the Law Society saw to it members of the public were denied access to justice and a solicitor to try and pursue the thousands of McCabes and Penmans for the damage they did to many clients.

Michael Clancy, Director of Law Reform. Despite the hundreds of ‘crooked lawyer’ scandals in the last two decades, and all the promises of reform from the Law Society itself, nothing has been done to help thousands of people with outstanding cases against crooked lawyers, and some at the Law Society such as Michael Clancy, have come down hard against any proposals to bring in Parliament or new legislation to help clean up the legal profession’s sins of the past.

Michael Clancy, Director of Law Reform. Despite the hundreds of ‘crooked lawyer’ scandals in the last two decades, and all the promises of reform from the Law Society itself, nothing has been done to help thousands of people with outstanding cases against crooked lawyers, and some at the Law Society such as Michael Clancy, have come down hard against any proposals to bring in Parliament or new legislation to help clean up the legal profession’s sins of the past.

You can read my own proposals, in effect. a “Truth & Reconciliation” proposal for the Law Society’s sins of the past here : The polluter pays - Why cleaning up lawyers sins of the past would be good for the public & legal profession alike

We are now at a point where no matter the scale of corruption in Scotland’s legal services market, nothing will bring the reforms and consumer protection that all Scots and consumers of legal services in this country should have. The feeling now by many is that when someone goes to a lawyer, the odds are they are going to get ripped off, and with lawyers experiencing a marked downturn in legal business, levels of fraud against clients through faked up legal fees and menacing demands for expenses on work not carried out are sharply rising.

If we are to have good regulation of legal services in Scotland, the Law Society of Scotland and those associated with it, presently or formerly, cannot be allowed anywhere near such a body, as the crop of scandals at the Scottish Legal Complaints Commission show very clearly.

As long as we have a Justice Secretary who says he will protect lawyers from much needed reforms, the Scots public will always take second place to the criminal element of society that walks around with a Law Society of Scotland membership badge, professing to offer the best in legal services when in reality they offer levels of toxicity to consumers that Chemistry could never hope to define.

20 comments:

Yes you are right Peter,nothing changes very much in 20 years and its no coincidence those people have been in their positions to stop the changes.

Keep up the good work.

Do you think the hootsmon are watching ?funny thing I just did a search on google and came up with this :

http://edinburghnews.scotsman.com/dont-miss/John-McCabe-Solicitor-left-banks.5018412.jp

John McCabe: Solicitor left banks and building societies reeling

Published Date: 26 February 2009

By Gina Davidson

IT was the multi-million pound white-collar crime which knocked the stuffing out of the starched shirts of Edinburgh's legal profession.

When solicitor John McCabe was arrested at Heathrow after an attempted escape to Uruguay, it was revealed that he had lost almost £7 million through a catalogue of property frauds which left the city's banks and building societies reeling – and law firms the length and breadth of Scotland financially worse off.

McCabe perpetrated Scotland's biggest legal fraud over a period of seven years, becoming increasingly devious – even conning his wife – and damaging the reputation of and trust in his profession.

In a complex network of fraudulent transactions, he obtained, by lies and forgery, increasingly large loans on already mortgaged property, using the cash to expand his property empire and invest in nursing homes. But as property prices fell and interest rates rose in the late 1980s his debts spiralled and McCabe had to borrow more and more money. By November 1989, he was having to find £120,000 a month to keep up interest payments on loans.

Even his own house in the heart of Edinburgh's affluent New Town was not safe from his greed. The original loan on the Northumberland Street house was just £50,000, but in a series of further loans, on which he forged his wife's signature, he obtained a further £250,000.

The frauds only came to light after the Law Society carried out a routine examination of the books at the now dissolved Scott Moncrieff and Dove Lockhart firm, where McCabe was senior partner. In panic, knowing he was about to be found out, he fled to Uruguay after wiring £300,000 to a friend's bank account.

But the friend, sensing trouble, went to the British Consul, who established McCabe was under police investigation. The account was frozen and McCabe's money impounded by police. Destitute, he gave himself up and helped police unravel his web of fraud. The frauds totalled more than £4m and on top of those he had debts of more than £2m.

The whole fraudulent business began in 1983 when, as a 34-year-old, he decided to raise money on his own house. Borrowing almost £20,000 from the Skipton Building Society, he falsely claimed the cash was to be used to carry out "repairs and improvements" – and forged his wife Helen's signature.

For two years he was satisfied with that financial injection, but in 1985 he again borrowed £19,250 for the same purpose – and again forged his wife's signature.

The following year, in October, he forged her signature for a £54,698 mortgage from the Gateway Building Society to buy a house in Blantyre Terrace.

By 1987 he was stepping up his activities, desperate to become a property developer and enter the then-booming business of nursing homes. He applied for three more mortgages from three new building societies: £33,600 from the Halifax for a house in Maxwell Street, £63,826 from the Yorkshire for a house in Leamington Terrace and £40,000 from the Nationwide for the basement of his house in Northumberland Street. For the last two deals he again forged Helen's signature.

Then McCabe really went for it. In 1988 he borrowed a total of £1,005,136 from ten different agencies. This time he only forged his wife's signature once, but variously stated to the building societies and banks that he had only one on-going mortgage, or none at all.

And he was believed. The banks and building societies accepted what he told them, partly because, while he had not recorded the titles of the properties on which he held mortgages, his word, as senior partner in a reputable firm of solicitors, was considered good enough.

By the end of 1988, McCabe had 11 mortgages on eight properties.

Then in 1989 McCabe went back to the Skipton to raise a further £60,000 on his Northumberland Street home and took another £30,000 mortgage with the Newcastle for a property in Easter Road. He also approached the Jedburgh branch of the Bank of Scotland for a £150,000 term loan, supposedly to inject capital into a company called Peter Moffat (Potatoes). He offered four properties as security without mentioning existing mortgages on them.

In the same month he got an overdraft of £390,000 from the Clydesdale Bank to convert the Leamington Terrace properties into a nursing home, pretending again that there were no existing overdrafts, mortgages or loans.

But McCabe's guest houses and nursing homes were not proving the goldmines he expected them to be, and his debts were growing all the time.

In December that year came his biggest deals yet. On the 6th, he obtained a commercial mortgage from the Alliance & Leicester of £534,870, supposedly with a business associate, to buy a property in Eglinton Crescent. Ten days later, he applied for another commercial mortgage from the Newcastle, for the same house, and got £504,000.

But the Newcastle would not agree to allow him to act for them as well as himself due to a potential conflict of interest in the deal, but asked Edinburgh solicitors JC&S Stewart to act for them.

McCabe's wife Helen was a partner in JC&S Stewart and was given the task of handling this mortgage. She failed to record the title, but instead handed the deed and the file to her husband (later the Newcastle successfully sued JC&S Stewart for negligence).

It was obvious that by this stage McCabe was a desperate man who was prepared to throw away his wife's career to save his own skin.

In 1989 alone, McCabe obtained £1,668,870 from two banks and three building societies and was already paying £120,000 a month in interest on loans. Roughly calculated, at the rates then current on property loans, he would have to have debts of around £7m to incur this amount of interest.

The total amount of fraud for which he was eventually tried, however, was £4,075,226. And that includes further phenomenal borrowings in 1990.

By this time, he must have realised the game was up and decided to go out with a bang. In 1990 his borrowings totalled £1,323,000, with eight mortgages taken out: four on one house in Belford Court, two more on the Blantyre Terrace house (making four mortgages on that property altogether), one "remortgage", one for garage premises and one plot of land. Ten agencies were deceived.

The "improvements" at Northumberland Street reached their peak in June when he again applied to the Skipton for a loan of £118,000 – and got it. A spokesman for the Skipton later said that as long as the client provided proper security, a valuation and proof of income, the loans he had received, totalling £243,000 in seven years, were perfectly acceptable practice.

Eventually realising the game was up, McCabe fled to Uruguay at the end of 1990. But the money he had sent on came back to Scotland – and so did he.

He made a full confession to debts of more than £4m, nearer £5m with interest. He also had personal debts of around £2m. Unsurprisingly when the facts were revealed, there was speculation about gold-plated Jacuzzis and air-conditioned wine cellars, though it appears that the McCabes did not have an ostentatious lifestyle.

What McCabe's case illustrated at the time were the long delays in the recording of title deeds. As long as the properties he mortgaged were not recorded, building societies and banks could not discover that he had already mortgaged them.

McCabe was sentenced in 1991 to ten years in jail after admitting 34 charges of fraud.

Where did all the money go? None of it was ever retrieved and £4m, at least, was said to have gone on business failures and interest payments.

His wife Helen claimed at that time that she had acted under duress from her husband, and knew nothing about his affairs. But she was later found guilty of professional misconduct by the Scottish Solicitors Discipline Tribunal and censured over two cases involving building society loans to her husband.

She was also later evicted from 52 Northumberland Street as their home had been left encumbered by mortgage arrears of more than £660,000.

And because McCabe was declared bankrupt, the Law Society of Scotland's guarantee fund, to which all solicitors have to contribute, had to pay out to meet the claims for compensation by victims of the dishonest lawyer. As a result, every solicitors practice in Scotland that year had to pay £900 to the fund.

Perhaps it was Robert Henderson QC, for McCabe, who summed up the case best when he said his client had been an unqualified success as a lawyer but a complete failure in his efforts to branch out into business.

"He was out of his depth and as he became more and more desperate for money, the frauds multiplied. It was a case of fraud on fraud on fraud," he said.

What a catalogue of shame - just a pity that these corrupt indviduals do not know the meaning of the word - and care less - while every major political party in Scotland has shown itself content to do nothing to instruct them.

Nice find Peter.Those were the days John Robertson could write a story about bent lawyers without fear the Law Society would ring up and threaten the paper.

Hell of a world it turned out for us after Penman !

Rotten to the core is what it amounts to and all these politicians who are so in love with the bankers are just as much in love with lawyers

Time to end it all and I for one would not shed one bloody tear if a few jumped off the tallest buildings around.

regarding Macaskill - the only reason someone protects his profession and colleagues like that is because he has something to gain - probably financially so as long as there is a sniff of money or a job at the end of it Kenny will do what's right for lawyers and what's wrong for the rest of us

You don't realise the favour you did us by ousting Mill from the law society (or maybe you do)

He might still be hanging around at Glasgow Uni but at least he's out of our hair now.Try for the others if you can - they are just as dangerous to both sides

Points well made Peter but the SNP's answer to the financial crisis is to grab headlines by putting up the price of booze.

They dont give a shit about anyone who isnt in their party and that includes most of Scotland

Fair sentiments given the circumstances and you forgot to say Mill should have taken those two with him on leaving Drumsheugh Gardens

What you are trying to say is that with all these bent lawyers Mill Yelland & Clancy should have been chucked out years ago.

I certainly agree with that!

Totally agree with your post and this yelland character has done a lot of damage to people I bet

nuff said - the lawyers had 3 fred goodwins !

Dear Mr Cherbi

I have a very serious problem with this Philip Yelland you mention.

For 3 years I have been trying to get my complaint against my solicitor heard by a committee and this Yelland keeps delaying it so the lawyer concerned can retire and they dont need to do anything about it.

My complaint was about fees which my lawyer lifted directly from my bank account and you might not be surprised to hear I used to bank at the RBS at the time and when I asked for an explanation they said I had issued a cheque but it took them 3 weeks to produce it and when it arrived the signature was just a line.I reported the matter to the Police who agreed the cheque is a forgery but the Law Society have still done nothing and are trying to put off helping me and this guarantee fund is rubbish too because they wont let me anywhere near it.I would like to tell my story to you a bit more if you have the time and an email or address please

The Guarantee Fund as everyone knows has a torturous claims process designed to throw most people off (about 80% some say)

Interesting the Scotsman dragged up John McCabe last week too.Has the paper had a change of heart on the legal profession or does the omission of Pritchard's failed reforms indicate more of the same ?

interesting to hear the rbs are the law society's bank

i bet that could throw up a lot of investigations on its own if you tally how many bent lawyers have robbed clients who did business with the rbs and got away with it

I see Clancy stood on your petition very hard.He is one of those who likes to keep things as they are - in favour of his colleagues.

comment 4 - Spot on according to a friend of mine who used to work at the hootsmon

Imagine if each lawyer stole 4 million ? Probably they already have !

Peter. As long as the Law Society is in charge there will be no improvement for both sides of the debate on reforming regulation or legal services.

Crooked lawyers give Scotland a bad name.

The Law Society also gives lawyers a bad name. By protecting their members interests, the problem is compounded, in the public perception. This is because of the cover up culture which prevails, this means that the public cannot trust any lawyer. Lawyers are protected rather than prosecuted and the Law Society are shooting themselves in the foot. It really defies belief that a profession with this level of power, can look into complaints from members of the public about fellow lawyers.

Post a Comment