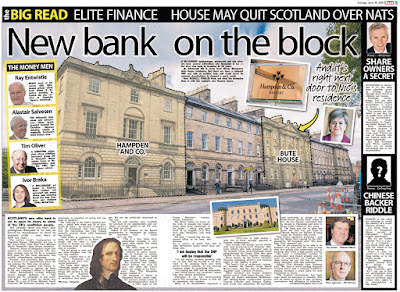

Judges, mega rich & offshore money mix in new Scots bank. A RICH LIST of investors in Hampden & Co - Scotland’s first new bank in 30 years – reveals members of the judiciary including a suspended judge - among the ranks of billionaires, aristocrats and anonymous offshore trusts who have pumped in £40 million into the financial institution - located in Charlotte Square, Edinburgh.

Judges, mega rich & offshore money mix in new Scots bank. A RICH LIST of investors in Hampden & Co - Scotland’s first new bank in 30 years – reveals members of the judiciary including a suspended judge - among the ranks of billionaires, aristocrats and anonymous offshore trusts who have pumped in £40 million into the financial institution - located in Charlotte Square, Edinburgh.

Among the ranks of investors in the new bank are figures from the judiciary such as the now suspended Sheriff Peter Black Watson – who was suspended from his current judicial duties by Lord President Lord Gill in February of this year - in relation to legal writs linked to the £400m collapse of hedge fund Heather Capital.

Other judicial figures include Court of Session judges and former EU judge, Scottish lawyer & academic Sir David Edward KCMG QC FRSE.

Today, the Judicial Office for Scotland refused to comment on, or confirm the identities of any judges who hold shares in the new bank.

Hampden & Co annual return reveals wealthy shareholder list. In accounts filed by Hampden & Co, Edinburgh, a Michael Scott Jones - is the registered as owner of 200,000 shares.

Hampden & Co annual return reveals wealthy shareholder list. In accounts filed by Hampden & Co, Edinburgh, a Michael Scott Jones - is the registered as owner of 200,000 shares.

The Judicial Office refused to confirm or deny if this is the same Michael Scott Jones who is Court of Session judge Lord Jones.

The accounts for the bank also reveal Peter Black Watson is the holder of 400,000 shares.

While the Judicial Office refused to confirm if this is the same Peter Black Watson who was suspended by Lord President Lord Gill earlier this year “to maintain public confidence in the judiciary”, Watson’s identity as one of the shareholders of Hampden & Co has been confirmed in a report in The Scottish Sun newspaper earlier this week.

Speaking to the media today, the Judicial Office refused to be drawn on the issue of judges investments and the need for a register of judicial interests to enable the public to scrutinise judges interests and links to big business, banks and other vested interests.

A spokesperson for the Judicial Office for Scotland would only say : “Personal investment decisions are a matter for individual judicial office holders.

“Judicial office holders are bound by the Statement of Principles of Judicial Ethics and in the event of a case presenting a potential conflict of interests, by reason of an investment or otherwise, will recuse themselves. These recusal decisions are a matter of public record”.

However, it is a matter of public record not one Scottish judge has declared a financial interest in a case which has resulted in a published recusal, and one senior Sheriff – Sheriff Principal Alistair Dunlop - who held shares in Tesco – did not recuse himself in the case involving the supermarket giant.

No public record of any refusals or failures of judges to recuse themselves have appeared in the list of recusals published by the judiciary.

Neither have any financial details of members of the judiciary appeared in the list of recusals.

A petition currently under consideration by the Scottish Parliament - Petition PE1458: Register of Interests for members of Scotland's judiciary - calls for the creation of a single independently regulated register of interests containing information on judges backgrounds, their personal wealth, undeclared earnings, business & family connections inside & outside of the legal profession, offshore investments, hospitality, details on recusals and other information routinely lodged in registers of interest across all walks of public life in the UK and around the world.

The petition has cross party support from msps who backed a motion urging the Scottish Government to create a register of judicial interests at Holyrood on 7 October 2014 - reported along with video footage and the official record, here: Debating the Judges.

In an investigation earlier this week by the Scottish Sun newspaper, it was revealed there are fears among some of Hampden & Co’s shareholders of a second independence referendum, tax rises and how the business climate in Scotland will fare under policies of the SNP Scottish Government.

In an investigation earlier this week by the Scottish Sun newspaper, it was revealed there are fears among some of Hampden & Co’s shareholders of a second independence referendum, tax rises and how the business climate in Scotland will fare under policies of the SNP Scottish Government.

The bank’s investor list reveals predominantly rich, unionist shareholders such as tycoon Alastair Salvesen, self-storage tycoon Alister Jack, Greenock-born financier Malcolm Offord, Dobbie's garden centre chief James Barnes, Edinburgh art dealer Alexander Meddowes and Stirling-based construction tycoons Duncan Fletcher & Duncan Ogilvie, both worth over £50million. Aristocratic customers includes the Queen's cousin David Bowes-Lyons and the Earl of Rosebery's daughter Lady Caroline Primrose.

Euripides Investments Ltd, the new bank's second largest shareholder, is based in Jersey — meaning its ownership is secret and that owners are likely to pay less tax on profits than individual UK shareholders.

Another major shareholder is Guernsey-based Kusapi Ltd.

Hampden & Co are refusing to reveal the identity of a major Chinese investor - Cai Dang Fang – listed in Companies House records as Hampden's fourth largest shareholder. But it's not known whether that is a person or a company — and the bank won't say if they are based in the UK or overseas.

The private bank's headquarters in Charlotte Square, Edinburgh, are just a few doors away from First Minister Nicola Sturgeon's Bute House residence.

However, many of Hampden's super-rich backers are staunch unionists who fear their savings may be hit by a rampant SNP push for full fiscal autonomy and another independence referendum.

Speaking to The Sun – Founder & Chairman Ray Entwistle (70) insisted "we have absolutely no intention of racing into any kind of decision".

But referring to the SNP's election success he warned: "I suspect a host of businesses that were anxious over the referendum last year remain partially anxious about what happened last month.

"This bank is registered in Scotland, the head office is in Edinburgh and we have a large number of friends we want to do business both in Scotland and in London.

"We are going to wait and see what happens over the next few months. "And I suspect that a lot of other businesses are waiting to see what transpires politically."

Commenting on the bank, Deputy First Minister & Finance Secretary John Swinney said: "We have a world-leading financial services sector and a talented workforce, making Scotland a great place for new businesses to locate. The Scottish Government has been clear about its approach to taxation. This will be based on ability to pay, certainty, convenience and efficiency of collection."

THE SUSPENDED SHERIFF

Lord Gill (73) suspended Sheriff Peter Black Watson (61) after demanding sight of a multi million pound writ against Glasgow law firm Levy & Mcrae - Watson’s former law firm - which is one of several companies being sued by Heather Capital’s liquidator, Ernst & Young, after the fund's collapse in 2010. Watson was a director of a company called Mathon Ltd, and another - Aarkad PLC - key parts of the Heather empire.

The collapsed hedge fund Heather Capital – run by lawyer Gregory King is now the subject of a Police Scotland investigation and reports to the Crown Office. Gregory King – a lawyer - is named along with three others – lawyer Andrew Sobolewski, accountant Andrew Millar and property expert Scott Carmichael in a police report.

An earlier statement from the Judicial Office for Scotland on Watson’s suspension reported: Sheriff Peter Watson was suspended from the office of part-time sheriff on 16 February 2015, in terms of section 34 of the Judiciary and Courts (Scotland) Act 2008.

“On Friday 13 February the Judicial Office was made aware of the existence of a summons containing certain allegations against a number of individuals including part-time sheriff Peter Watson. The Lord President’s Private Office immediately contacted Mr Watson and he offered not to sit as a part-time sheriff on a voluntary basis, pending the outcome of those proceedings.

Mr Watson e-mailed a copy of the summons to the Lord President’s Private Office on Saturday 14 February. On Monday 16 February the Lord President considered the matter. Having been shown the summons, the Lord President concluded that in the circumstances a voluntary de-rostering was not appropriate and that suspension was necessary in order to maintain public confidence in the judiciary.

Mr Watson was therefore duly suspended from office on Monday 16 February 2015.”

BANK OPENS AMID GLARE OF PUBLICITY:

Today, 18 June 2015 – Hampden & Co., the first private bank to come through the new process to obtain a banking licence, has opened its doors to clients after securing final regulatory approval at the beginning of June. It is the first private bank to be set up in the UK for 30 years and will address the significant demand in the UK for a new, high quality banking service.

Founded in 2010 by Ray Entwistle, the former Chairman of Adam & Company, the bank has recruited an impressive team of over 50 qualified professional bankers and support staff, headed up by Chief Executive Graeme Hartop, formerly CEO of Scottish Widows Bank.

The bank will deliver a traditional private banking service built on long-term client relationships and personal service from offices initially in Edinburgh and London. Capital of nearly £50 million has been raised for the launch, which demonstrates the confidence investors have in the business opportunity.

Ray Entwistle commented: "There is strong demand for a new private bank which delivers the right quality of service with long-term continuity of personnel and speed of decision making. Over 250 shareholders have come to the same conclusion and they have been prepared to back our experienced team with the capital required to launch our new bank."

Graeme Hartop added: "The timing for launch is ideal as we continue to experience an improved economic environment, strong client demand and a favourable competitive landscape as a large number of the existing banks continue to deal with significant legacy issues. We will deliver a traditional client-led private banking service, fully focussed on client needs and not product sales targets, which will lead to strong client-to-banker relationships. We are delighted to be welcoming clients on board."

22 comments:

So they will do well in court if they ever have any trouble!

Having judges on their shareholder lists must be very advantageous and lucrative to businesses..

We should be paying more attention to how the judges slosh their money around and who exactly benefits from this..

Nice company they keep

“Judicial office holders are bound by the Statement of Principles of Judicial Ethics and in the event of a case presenting a potential conflict of interests, by reason of an investment or otherwise, will recuse themselves. These recusal decisions are a matter of public record”.

Absolute garbage.

Just think of the headlines of politicians said they were going to scrap their own registers of interest and bring in a set of ethics to hide all their corruption and bribes in the same way the judges do.

Now we are beginning to see why Lord Gill fought so hard to keep this information from becoming public.Too late Brian we all must know what is going in with your pals on the bench just think of all the conflicts of interest arising from judges links to banks and people in courts day in day out taking legal action against a bank or the bank making someone homeless.It has all got to come out and be published.

Doubt they will be happy you posted the entire shareholding list but it is a public document and as you say judges should declare their interests.

Here's a thought to any new Lord President - get some honesty and publish all your interests.

There are a lot of names on the shareholder list matching up to lawyers and others they will almost certainly have some kind of links.I saw your tweets on the story earlier in the week and already subscribed so was able to read the main article by Russell Findlay.Very thorough.More please.

Bankers lawyers and judges what is the difference?

NONE except maybe no judge seems to have jailed any of the bankers for ripping us all off!

I now see where you are coming from on judicial interests,they are everywhere banks offshore everything and yes it ought to be declared.

Conflict of interest?.....trust us say the judges (supported by the Sturgeon, McAskill and Co).

If they have nothing to hide they have nothing to fear - make the register of interests law NOW!

Did the bank enjoy your coverage of their opening day?LOL

Probably not!

Nice one anyway and good to see more judges interests coming out finally

Someone stamping their ownership of Scotland right in our face - office right next to Sturgeon,sounds to me like a warning shot across the bows of Scottish independence.

How about maintaining public confidence in the banking system by jailing bankers instead of cuddling up to them!

@ 18 June 2015 at 17:54

Think of it as an extension of influence and power in certain circles ...

@ 19 June 2015 at 11:07

Yes .. and the irony in those allegedly close to some in the party are investors in anti-independence banks ...

@ 19 June 2015 at 12:35

Almost unthinkable, given the extent of business and family links between the judiciary, the legal profession and the banking sector.

The Courts tell us that it is perfectly all right and above board for GCHQ and others to engage in the mass surveillance of the Public's previously private telephone calls, emails and internet use - BUT - they refuse point blank to engage in even the most basic level of transparency and openness themselves.

More double standards (to accompany double dealing) anyone?

"Almost unthinkable, given the extent of business and family links between the judiciary, the legal profession and the banking sector."

Correct!

Was it worth it to Gill telling the parly to get stuffed just because he and presumably his colleagues on the bench did not want to reveal all these monied connections with people who call themselves 'the great and the good'

Is this another of those brilliant but dodgy Scottish financial products we should keep a good eye on?

Interesting a unionist bank starts up in Scotland just a few months after the indyref wonder what they are up to?

The RBS and the Bank of Scotland go down the tubes and end up being consumed by the British Tax Payer, whereupon they cannot break even, then in the vacuum up pops a new Scottish bank?

Wonder where all this new money came from?

A good investigation by The Sun (Scotland) and lays it on the line unlike soppy versions in the financial press who would have missed out the shareholders including the judges for obvious reasons.

Hello from across the pond!

Your post and the newspaper's investigation makes me wonder what really goes on in the banking and legal fraternity and why some people are so eager to protect their secrets.There is nothing wrong in having private banks however it must all be out in the open especially judges and public servants if you really want to clean up what is a very rotten industry!

People keep asking why no bankers are jailed well the answer is staring you all in the face because judges have shares in the same banks!

There is a similar petition to create a register of judicial interests for UK Judges:

https://petition.parliament.uk/petitions/263400

Post a Comment